Debt Ceiling Showdown: What It Could Mean for the Economy

Are we in for a debt storm?

There has been a lot of chatter in the news these days about the federal debt ceiling. But what does it mean for the average consumer, and how could it affect the economy in the months to come?

Let's recap what we know with some educated speculation about what could happen next.

First of all, what is the debt ceiling and why is it in the headlines (again)?

The federal debt ceiling is a limit on how much the U.S. Treasury can borrow to pay government commitments already approved by Congress.1

Once the ceiling is reached, Congress must either increase or suspend it so the Treasury can issue new debt and raise the money needed to cover its bills.

Once an ordinary part of federal accounting, adjusting the debt ceiling is now a political negotiation, threatening the Treasury Department’s ability to pay its bills next month.

Though it’s unlikely either party will allow the U.S. to default on its obligations, this political brinkmanship adds anxiety each time it comes up.

What would happen if Washington doesn’t reach a resolution?

Treasury Secretary Janet Yellen has warned that the U.S. could run out of money by June 1 if Congress doesn't act.1

While so-called "extraordinary measures" are being used to extend the timeline, if neither side budges, the U.S. could officially default on its sovereign debt for the first time in history.

Even if Congress quickly reversed course, a temporary default could still trigger a market correction and agitate credit markets.

Given how fragile the collective American psyche is about the economy right now, a default could trigger a recession or major job losses as businesses pull back on spending.

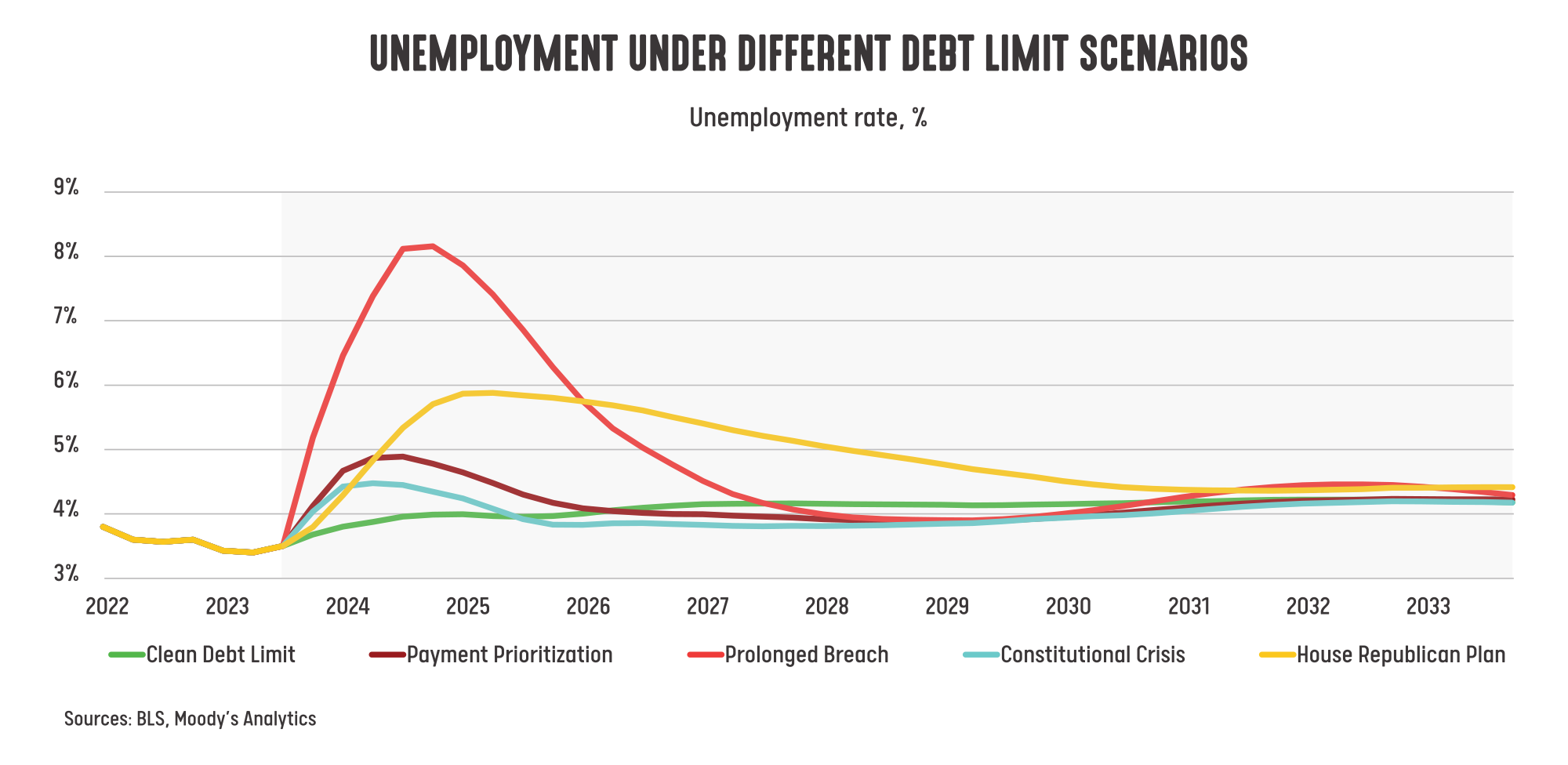

The chart below projects unemployment across multiple potential default scenarios that are being discussed.2

You can see that most of them could result in a spike in unemployment as a default ripples through the economy.

Bottom line: A debt default could be very bad news for global markets and the U.S. economy.

But here's the potential good news: It doesn't seem likely that either political party will allow the U.S. to default on its debts.

The price of an impasse is too high; however, it could happen, so let's be prepared for that eventuality.

What can we do about the debt ceiling showdown?

Not much.

As investors and consumers, we're just along for the ride.

However, despite the inherent challenges and uncertainties in this situation, it is crucial to remember that the economy has proven its resilience time and again. As policymakers and stakeholders navigate the complex web of fiscal decisions, it is essential to maintain balance and keep a level head when making individual financial decisions in our own lives. We are keeping a close eye on the situation, and will share further updates as warranted.

Want to discuss in more detail? Feel free to reach out to our office to speak with a member of our professional team. We're happy to lend an ear or provide some guidance as desired.

Sources:

- https://www.cnbc.com/2023/05/09/debt-ceiling-explained.html

- https://www.moodysanalytics.com/-/media/article/2023/going-down-the-debt-limit-rabbit-hole.pdf

Disclaimer:

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.