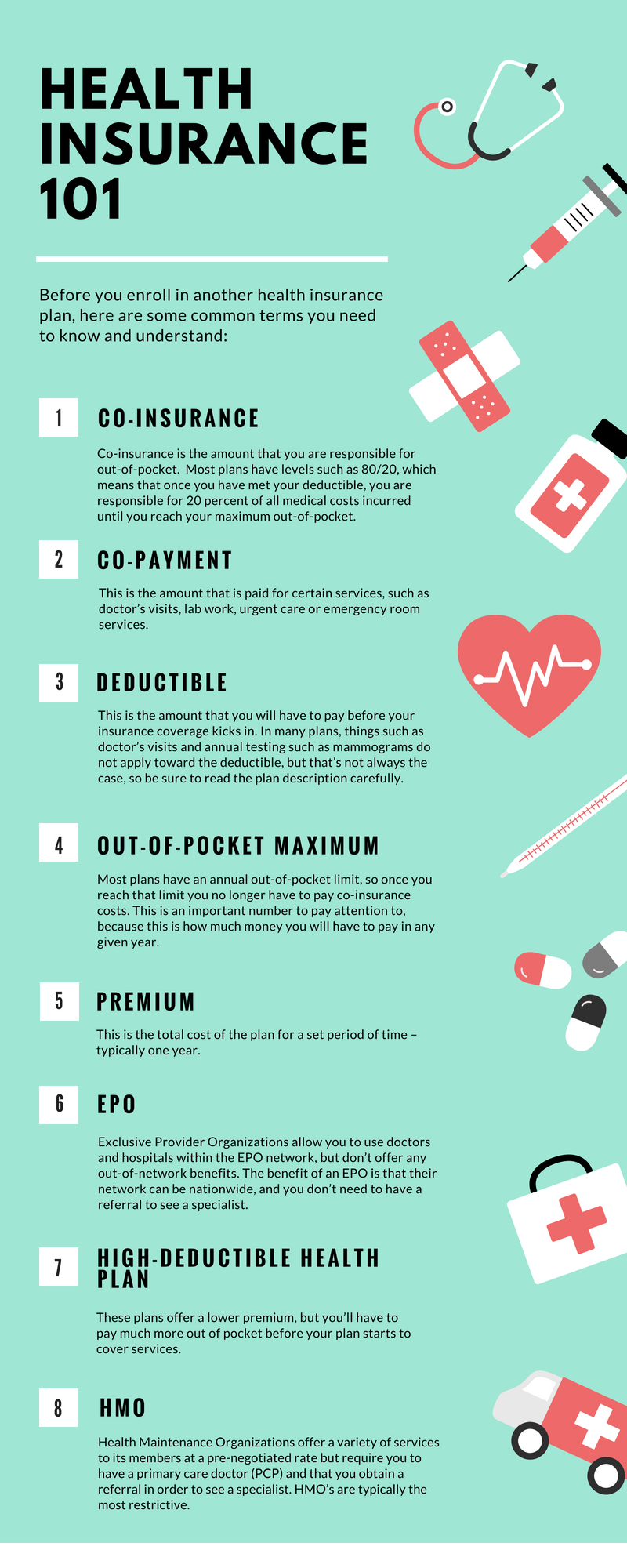

[Infographic] Health Insurance 101

Health insurance can be a labyrinth of complex terms, coverage options, and financial considerations. Whether you're new to the world of health insurance or just looking to brush up on your knowledge, our "Health Insurance 101" infographic will help to shed some light on the key concepts you need to understand. We'll walk you through the basics of health insurance, breaking down the jargon and helping you make informed decisions about your healthcare coverage.

Co-Insurance

Co-insurance refers to the percentage of medical costs you share with your insurance provider after meeting your deductible. For example, if your co-insurance is 20%, you'll pay 20% of covered expenses, while your insurance covers the remaining 80%.

Co-Payment

A co-payment, or co-pay, is a fixed amount you pay for specific medical services, such as doctor's visits or prescription medications. Co-pays are typically due at the time of service and are separate from your deductible and co-insurance.

Deductible

Your deductible is the amount you must pay out of pocket for covered healthcare services before your insurance kicks in. For instance, if your deductible is $1,000, you'll pay the first $1,000 of eligible medical expenses, and then your insurance will start covering costs.

Out-of-Pocket Maximum

This is the most you'll have to pay for covered healthcare services in a plan year. Once you reach your out-of-pocket maximum, your insurance should cover 100% of eligible expenses. It includes your deductible, co-insurance, and co-pays.

Premium

Your premium is the regular payment you make to your insurance company to maintain your coverage. It's usually paid monthly and does not count toward your deductible or out-of-pocket maximum.

EPO (Exclusive Provider Organization)

EPO plans offer a network of healthcare providers, and coverage is only provided when you use these in-network providers. Exceptions are made for emergencies or out-of-network care when authorized by the insurance company.

HMO (Health Maintenance Organization)

HMO plans emphasize preventive care and require members to choose a primary care physician (PCP). Referrals from the PCP are often necessary to see specialists, and out-of-network coverage is typically limited.

High-Deductible Health Plan

A high-deductible health plan is characterized by a higher deductible and lower premiums. These plans are often paired with Health Savings Accounts (HSAs) and can be a tax-advantageous way to save for medical expenses.

Understanding these fundamental health insurance terms and plan types is the first step toward making informed choices about your healthcare coverage. Whether you're choosing a plan for the first time or considering a change, be sure you understand your healthcare options so that you can make the right decisions to protect your health and your wallet!

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2026 Advisor Websites.