Social Security Updates for 2024

Each year, the Social Security administration releases updated numbers for Social Security benefit limits, cost-of-living adjustment (COLA) and more for the following year. Here are a few changes to be aware of for 2024

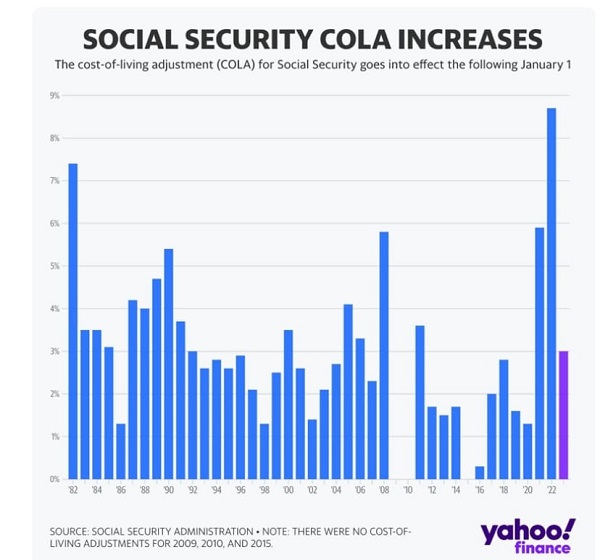

Cost-of-Living Adjustment (COLA)

The COLA is designed to help Social Security benefits keep pace with inflation. With record inflation in recent years, last year's COLA was the largest increase in over 40 years.

This year's increase will be more on pace with historical averages, although still a bit higher than norms for the past decade, at 3.2% starting January 1, 2024.

Taxable Maximum

The taxable maximum, which is the maximum amount of earnings subject to the Social Security tax, is increasing to $168,600, up from $160,200 in 2023. Up to this amount of earnings will be taxed based on your provisional income amount, and whether you are married or single.

Earnings Test Exemptions

The earnings test exemption is the amount of income you can make after claiming Social Security without reducing your benefit. This only applies if you are still working after claiming, but you are younger than full retirement age (FRA).

For 2024, the exempt amount is $22,320 per year. Earnings above this amount will reduce your benefit by $1 for every $2 earned above the limit. If you are turning full retirement age in 2024, you can earn up to $59,520 before your benefit will be reduced (by $1 for every $3 above the limit).

Remember that once you reach your FRA, you can work and make as much income as you want without impacting your benefit.

Social Security Benefit Maximum

The maximum Social Security benefit for an individual retiring at full retirement age in 2024 is $3,822 per month, up from $3,627 in 2023.

If you receive Social Security benefits, you’ll receive a notification of the new amounts and numbers for 2024 either by mail or online through the my Social Security website before the end of the year. (You can also sign up for text or email notifications for new messages from Social Security, rather than waiting for a letter in the mail.)

Have questions about maximizing your benefits, or making sure you don't miss out on strategies that could potentially increase your benefit? Contact our office for a free initial strategy session with a Social Security planning specialist.

Disclaimer:

This document is for educational purposes only and should not be construed as legal or tax advice. One should consult a legal or tax professional regarding their own personal situation. Any comments regarding safe and secure investments and guaranteed income streams refer only to fixed insurance products offered by an insurance company. They do not refer in any way to securities or investment advisory products. The firm providing this document is not affiliated with the Social Security Administration or any other government entity.