[Podcast] Is 4% A Safe Withdrawal Rate for Retirement?

Most people ask one question as they near the finish line: "how much can I safely spend every year without running out of money?" That question launched the famous "4% rule," a rule of thumb born from William Bengen’s 1990s research showing a retiree could withdraw 4% of their portfolio in year one, then adjust that dollar amount with inflation for about 30 years.1 The appeal is obvious: a simple rule that turns a complex future into a single number.

But the market we invest in today is not the market of 1994. Portfolio construction, global access, and product design have all evolved, which is why safe withdrawal guidance should reflect both modern data and personal risk tolerance.

Bengen himself has updated his view, suggesting 4.7% can be reasonable under certain conditions.2 The key phrase is under certain conditions. Starting valuations, interest rates, fees, tax drag, and even how you react to drawdowns can shift results. On the other side, voices like Suze Orman argue for a very conservative 3% to reflect longer lifespans and greater uncertainty.3

These aren’t just dueling opinions; they represent different comfort levels with probability. A 3% rule aims to reduce failure risk, but it often demands more savings or lower spending. A 4.7% rule aims to optimize spending given diversification and better tools, but it rides closer to the edge when early market years disappoint.

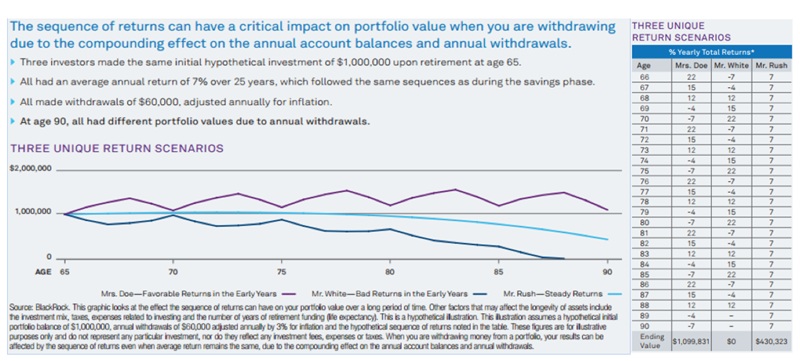

This is where sequence of returns risk enters the conversation, and it’s not negotiable. Two retirees can earn the same average return and end with opposite outcomes because the order of returns matters when withdrawals are happening. A few negative years early in retirement shrink the principal that generates future gains, creating a cash flow drag that a later rally cannot repair. That’s not opinion; it’s arithmetic.

The takeaway is that success is less about the “average” and more about protecting your plan from the first decade’s downside while maintaining enough growth to fight inflation for decades.

Blackrock Sequence of Returns Risk Chart5

So what can you do beyond tweaking a percentage?

One option is to pair market investments with a guaranteed income layer. For example, fixed indexed annuities with lifetime income riders can create a paycheck you can’t outlive, transferring longevity and sequence risk to an insurer.4

In the numbers discussed in this episode, it took far less capital to secure a $40,000 lifetime benefit with a top-rated carrier than to fund the same spending using a 3% or even a 4.7% withdrawal rate.

The trade-off is flexibility and potential upside.

The benefit is certainty: a floor that covers needs, so your remaining portfolio can be invested for growth with a steadier hand and fewer panic decisions during downturns.

The practical path blends these ideas.

First, define your spending into needs, wants, and wishes.

Next, line up guaranteed sources—Social Security, any pensions, and possibly an annuity—to cover the nonnegotiable needs.

Then, invest the remaining assets in a diversified portfolio aligned to your risk capacity and time horizon, with a distribution rule that flexes: take a little more in strong markets and trim during drawdowns.

Add tax-aware withdrawals, fee control, and cash reserves to buffer volatility, and you’re managing both probability and behavior.

The result isn’t a one-size rule; it creates a resilient income system designed to weather bad sequences, seize good markets, and keep your lifestyle steady.

Listen to the full episode:

Want to discuss your retirement income plan with a professional and make sure you're properly positioned to help ensure your retirement savings last as long as you do? Reach out to our office for a free retirement income strategy session today.

Sources:

1.) https://www.bankrate.com/retirement/what-is-the-4-percent-rule/

4.) Holistic Retirement Planning: Enhancing Outcomes with Insurance Products - By Ernst & Young [URL: https://www.ey.com/en_us/insights/insurance/retirement-insurance-plans-and-products-with-maximum-benefits]

5.) Blackrock Sequence of Returns Risk Chart [URL: https://www.blackrock.com/us/individual/insights/retirement-income]

Disclaimer:

The information presented here is for educational purposes only and is not a solicitation for the purchase of any financial product. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting financial professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.